Now Reading: How COVID-19 Changed Travel Insurance Forever

-

01

How COVID-19 Changed Travel Insurance Forever

How COVID-19 Changed Travel Insurance Forever

As the world grappled with the unprecedented challenges posed by COVID-19, virtually every aspect of daily life underwent a seismic shift—and the travel industry was no exception. For many, the advent of the pandemic meant halting dream vacations and rethinking plans that had once seemed foolproof. But it also catalyzed a conversion in the way travelers safeguard their journeys through insurance.Gone are the days of generic policies and one-size-fits-all solutions; in the wake of a global health crisis, travel insurance has emerged as an essential lifeline, evolving to address new risks and uncertainties. In this article, we’ll explore how COVID-19 has irrevocably altered the landscape of travel insurance, prompting innovations in coverage, policy design, and consumer expectations, forever changing the way we travel and protect ourselves on the road ahead.

The Rise of Comprehensive Coverage in a Post-Pandemic World

The COVID-19 pandemic has profoundly reshaped the travel landscape, particularly in the realm of travel insurance. Travelers are no longer satisfied with basic policies that merely cover trip cancellations; they now seek comprehensive coverage that addresses a myriad of potential hazards. As uncertainty looms, insurance providers have adapted to meet these demands by introducing policies that encompass not only standard trip interruptions but also emerging issues like pandemic-related cancellations, health emergencies, and quarantine costs. This shift has resulted in higher premiums, yet many travelers view it as a necessary investment in their peace of mind.

As travelers become increasingly aware of the importance of robust insurance, the market has responded with a surge in tailored plans. Notable features of modern travel insurance now include:

- Coverage for COVID-19 Related Expenses: Trip cancellations due to illness or government restrictions.

- Emergency Medical Assistance: Services for travelers who contract the virus abroad.

- Enhanced Support services: 24/7 assistance for navigating health crises while traveling.

The landscape is evolving,with travelers now expecting not only support during unforeseeable events but also clarity on coverage specifics. Insurers are increasingly providing transparent policy details to build trust and ensure customers have a complete understanding of their coverage. This ongoing evolution reflects a meaningful cultural shift in how travelers perceive risk and duty in an increasingly unpredictable world.

Navigating Policy Adjustments: What Travelers Need to Know

As travel continues to evolve in the post-pandemic landscape, understanding the emerging adjustments in policy is essential for every traveler. Insurance providers have modified their coverage to embrace unprecedented risks,creating a more robust framework that prioritizes consumer protection. Key changes include:

- Enhanced Coverage for cancellation and Interruption: More policies now cover trip cancellations due to unforeseen pandemic-induced factors.

- Inclusion of quarantine Costs: Some plans cover expenses related to mandatory quarantines during trips.

- Telehealth Services: Many insurers have integrated telehealth options for travelers in need of medical advice while abroad.

Furthermore, it’s significant to be aware of the fine print when evaluating new policies. Conducting thorough research can prevent complications down the line. Here’s a simplified overview of what to consider:

| Policy Feature | What It Covers |

|---|---|

| COVID-19 Coverage | Loss of deposits due to illness or travel restrictions |

| Medical Assistance | Emergency medical evacuations and hospital stays |

| Travel Support | 24/7 helplines for assistance and advice |

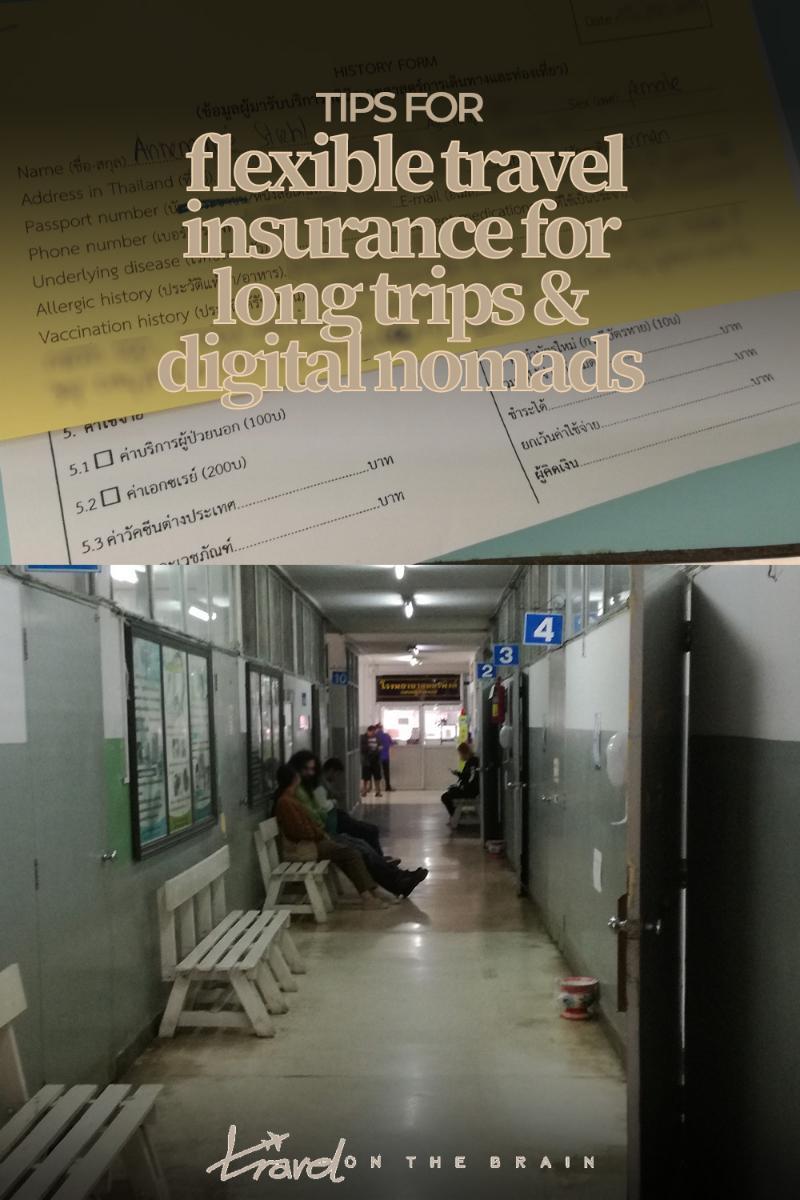

understanding the Importance of Flexibility in Travel Insurance

The pandemic has reshaped the landscape of travel, and with it, the need for adaptability in travel insurance has become ever more apparent. Flexibility in coverage allows travelers to respond to the unpredictable nature of global events. When considering a travel insurance policy, it’s essential to look for plans that offer features such as:

- Cancel for Any Reason (CFAR) – This option allows travelers to cancel their trip for reasons outside of the standard policy coverage.

- COVID-19 Coverage – Ensuring that medical expenses related to the virus, including treatment and quarantine costs, are included in the policy.

- trip Interruption Benefits - Providing compensation for interruptions due to unforeseen circumstances, such as travel restrictions or sudden illness.

Moreover, the ability to modify or extend a policy should also be front and center in any traveler’s considerations. Insurance providers are evolving to meet the needs of modern travelers by offering:

| Feature | Benefits |

|---|---|

| No Change Fees | Allows travelers to adjust trip dates without incurring extra costs. |

| 24/7 Customer Support | Provides assistance during emergencies, nonetheless of location or time. |

| Flexible Payment Plans | Offers options to spread the cost of the premium, making insurance more accessible. |

As customers navigate the complexities of post-pandemic travel, understanding these flexible options empowers them to make informed decisions. By prioritizing adaptable insurance solutions,travelers can embark on their adventures with confidence,knowing they are protected against the uncertainties that may arise.

Future Trends: Innovations Shaping Travel Insurance After COVID-19

The landscape of travel insurance is undergoing a seismic shift as a direct consequence of the COVID-19 pandemic. As travelers seek more flexible, transparent, and inclusive protection plans, insurers are leveraging technology to respond to these evolving demands. Innovations such as dynamic pricing models,which adjust rates based on real-time data,allow for more personalized coverage options.Furthermore, the integration of AI-powered chatbots and customer service tools enhances accessibility, enabling travelers to secure instant assistance tailored to their unique travel needs.

Additionally, the rise of pandemic-specific coverage is revolutionizing the industry’s offerings. Insurers are increasingly introducing plans that cover cancellations due to infectious diseases, medical expenses related to viral infections, and even quarantine costs. As consumer awareness grows, key considerations now include:

- Comprehensive policies that provide clarity and ease in understanding what is covered.

- Increased emphasis on wellness and safety provisions, addressing concerns related to health during travel.

- Partnerships with travel agencies to bundle insurance seamlessly with bookings.

| Feature | Pre-COVID | Post-COVID |

|---|---|---|

| Coverage for pandemics | No | Yes |

| Flexible cancellation policies | Limited | Expanded |

| Instant claims processing | No | Yes |

Closing Remarks

As we navigate the evolving landscape of travel insurance in the wake of COVID-19, one thing is clear: the pandemic has left an indelible mark on the industry. No longer just a safety net, travel insurance has transformed into a vital companion that travelers now consider essential to their journeys. The pandemic has prompted insurers to innovate and adapt, leading to more comprehensive coverage options and clearer terms for travelers seeking peace of mind.

In this new era, travelers are more informed and cautious, viewing insurance not merely as an afterthought but as a crucial element of their travel planning. As we move forward,the lessons learned during this unprecedented time will continue to shape policies,helping to create a more resilient and responsive travel insurance landscape.

The world is slowly reopening, and with it comes an prospect for a renewed sense of adventure. Whether it’s a weekend getaway or a grand international expedition, understanding the changed dynamics of travel insurance empowers us to explore the world with confidence.As we pack our bags and head toward new experiences, let us embrace these changes, knowing that we are better equipped than ever for the journey ahead. Safe travels!