Now Reading: 5 Mistakes to Avoid When Using a Travel Credit Card Abroad

-

01

5 Mistakes to Avoid When Using a Travel Credit Card Abroad

5 Mistakes to Avoid When Using a Travel Credit Card Abroad

Traveling abroad can be an exhilarating experience, with each new destination offering a unique tapestry of culture, cuisine, and adventure.However, navigating the financial landscape overseas can sometimes feel like exploring uncharted territory. For many travelers, a travel credit card can provide a convenient and rewarding way to manage expenses while on the go. But missteps in using these cards can lead to unexpected pitfalls that may overshadow the joy of your journey.In this article, we’ll unveil five common mistakes to avoid when using a travel credit card abroad, ensuring that your adventures remain as seamless and enjoyable as possible.Buckle up; a smoother financial journey awaits!

Understanding foreign Transaction Fees and Their Impact

When traveling abroad, it’s crucial to be aware of foreign transaction fees that can significantly impact your overall expenses. These fees are typically charged by credit card issuers on purchases made outside your home country, often ranging from 1% to 3% of the transaction amount. This seemingly small percentage can accumulate quickly, especially if you make multiple purchases during your trip. to avoid unexpected costs, check whether your travel credit card offers zero foreign transaction fees. This small detail can save you a substantial amount of money and ensure that your adventures don’t cost more than they should.

Understanding how foreign transaction fees are calculated is equally crucial to your financial planning. These fees are assessed when you make purchases in foreign currencies and might include additional charges from payment processors. Here are some key points to remember:

- Currency Conversion Rates: Be aware that the conversion rates applied during a transaction can vary, affecting the final amount charged.

- Dynamic Currency Conversion: When offered the option to pay in your home currency, decline; it’s often less favorable than using local currency.

- Card Type Matters: certain cards, especially travel-specific cards, often come with perks such as waived fees or bonuses for overseas spending.

Choosing the Right Rewards Program for International Spending

When it comes to maximizing your international spending, the right rewards program can make a significant difference.Consider programs that offer bonus points or cash back for purchases made abroad,ensuring that your spending translates into tangible rewards. look for options that provide enhanced benefits for travel-related expenses, as these can frequently enough yield greater returns. prioritizing a card that waives foreign transaction fees is also essential, as this can save you money on every transaction you make outside your home country.

in addition to evaluating the rewards themselves, take the time to investigate the overall flexibility of the rewards program. A well-rounded program will not only offer a variety of redemption options—such as travel, merchandise, and statement credits—but will also feature partnerships with global brands. Here are a few factors to evaluate:

- Redemption Ease: How simple is it to redeem your points for travel and other rewards?

- Travel Partners: Dose the program partner with airlines and hotels that align with your travel habits?

- Expiration Policies: Do your rewards have an expiration date, and if so, what is the duration?

navigating Currency Conversion Choices Wisely

When traveling abroad, the temptation to convert your currency at the point of sale can be hard to resist. However, opting for local currency can save you substantial amounts, as merchants often offer exchange rates that favor their profit margins rather than your wallet. Always check for the option to pay in local currency to avoid hidden fees and unfavorable rates. This simple oversight could protect your budget while you indulge in new experiences. Keep in mind that rates may vary significantly between various vendors—always be vigilant!

Additionally, it’s essential to understand the diffrent types of fees you may encounter during currency conversion. Many credit cards charge foreign transaction fees that can add up quickly, but some are designed specifically for travelers. These cards offer benefits such as zero foreign transaction fees and competitive exchange rates. Consider these options when applying for a travel card, as they can impact your overall expenses. Here’s a quick comparison of popular travel credit cards:

| Credit Card | no Foreign Transaction Fee | Rewards Program |

|---|---|---|

| card A | ✔ | 2x points on travel |

| card B | ✔ | 1.5% cash back on all purchases |

| Card C | ✖ | 3x points on dining |

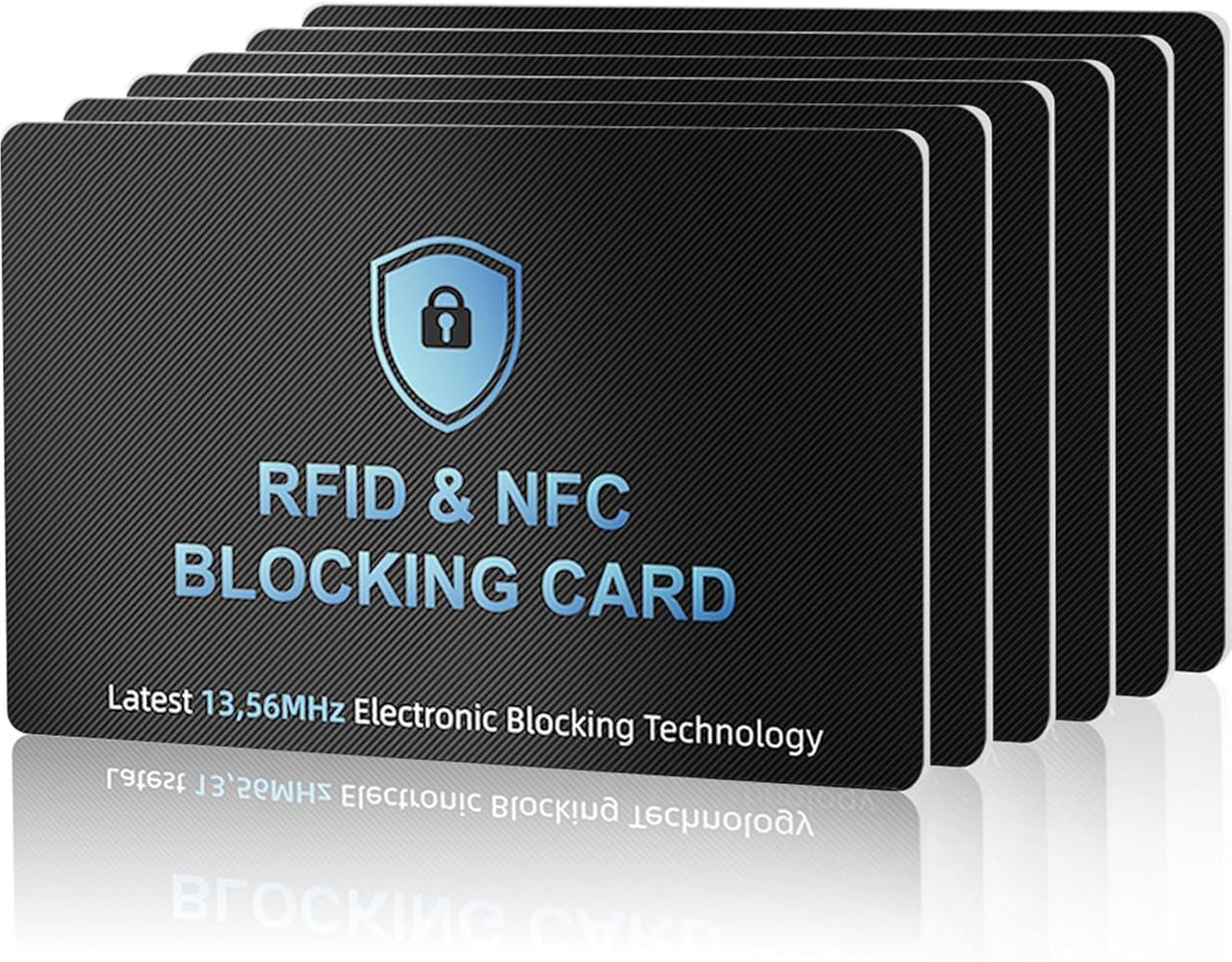

Keeping Your travel Credit Card Secure While Abroad

Traveling abroad frequently enough means navigating unfamiliar terrains and cultures, but ensuring the security of your travel credit card should always be a top priority.Here are some essential tips to safeguard your financial details:

- Activate two-factor authentication: Many credit card providers offer enhanced security features. take advantage of two-factor authentication to add an extra layer of protection.

- Use credit card alerts: Set up transaction alerts on your mobile device to monitor any suspicious activity instantly.

- Keep sensitive information private: Avoid sharing your card details,and be cautious when entering information in public places. Use secured networks whenever possible.

Another effective strategy is to maintain a strict inventory of your cards. Consider using a secure, travel-friendly wallet to minimize risk. Here’s a simple table of recommended practices:

| Practice | Description |

|---|---|

| Limit card usage | Use only one main card to minimize potential loss. |

| Maintain a backup | Carry an alternative card separately as a backup. |

| report lost cards | Contact your bank instantly if your card is lost or stolen. |

In Summary

As your travel adventures loom on the horizon, the last thing you want is to stumble over financial missteps that could dampen your journey. By steering clear of the five mistakes outlined in this article, you can wield your travel credit card to its fullest potential, unlocking a world of rewards and ensuring a hassle-free experience abroad. Remember, planning is key—armed with knowledge, you can navigate unfamiliar landscapes with confidence and enjoy the thrill of exploration without the weight of avoidable errors. Here’s to collecting not just points, but unforgettable memories and stories from every corner of the globe.Safe travels!